Client Accounting & Advisory Solution

Right People. Right Technology. HIGHER PROFITS.

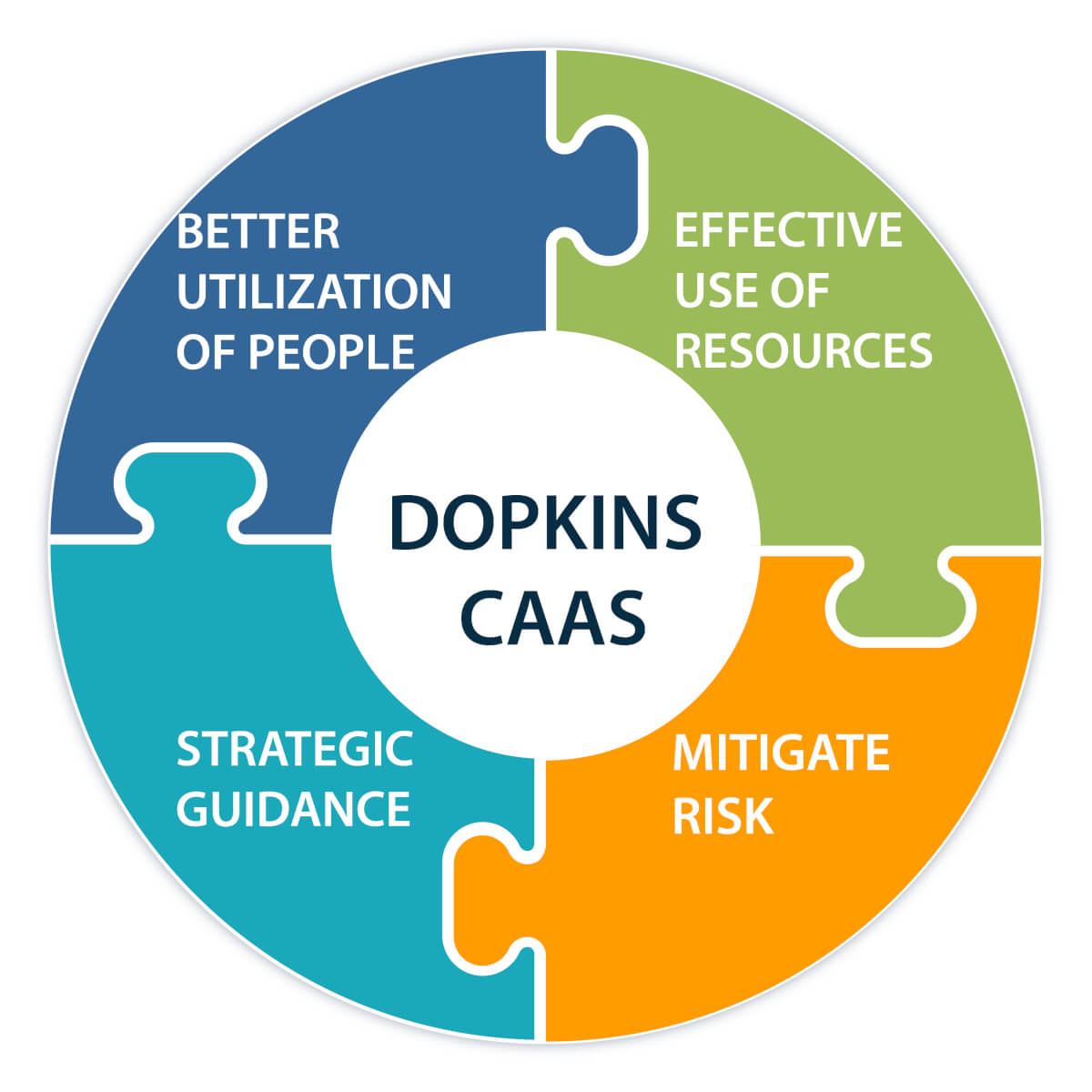

Dopkins Client Accounting & Advisory Solution (CAAS) is centered on helping our clients transform the accounting and finance function and other processes of their businesses to more effectively confront challenges and seize opportunities. Our CAAS team can drive business results and create value in four critical areas: Talent, Resources, Risk and Counsel.

Learn more below, or contact us to have a conversation.

- 1. TALENT ACQUISITION / RETENTION

-

- Loss of key employees involved in the accounting/finance functions to retirement (baby-boomers), relocation and other opportunities.

- Difficulty in finding qualified candidates to either replace key employees or to add to their teams:

- High level of competition for talent

- Extremely high demand for accountants

- Limited supply due to fewer college students choosing accounting as a profession

- Record-low unemployment, particularly for accountants

- 2. RESOURCE UTILIZATION

-

- People: Due to high demand and limited supply, the market value for qualified individuals is relatively high. Add the cost of benefits and hiring enough of the right people in the right roles could be cost prohibitive.

- Technology: The required investment in infrastructure to properly accommodate the accounting and finance function continues to rise as more software companies are moving to cloud-based platforms. The subscription fees can be high and the required investment in hardware, network infrastructure and security protocols to accommodate this infrastructure can be significant.

- 3. ORGANIZATIONAL RISK

-

- Increased organizational risk related to:

- Fraud

- Lack of effective internal controls

- Information security

- Process waste and variation

- Increased organizational risk related to:

- 4. NEED FOR HIGH-LEVEL BUSINESS ADVICE & COUNSEL

-

- Businesses of all types and sizes are becoming increasingly complex from an accounting and financial management perspective as to:

- Markets they serve: Global economy, multi-state, international

- Customers: How customers want to transact business has become more diverse

- Vendors: Terms & conditions and other aspects of the vendor relationship create accounting complexities

- As a result, the needs of a small or mid-market business are similar to a $50 million business, just on a lesser scale. A typical $50 million business invests approx. $800K per year in the following roles:

- CFO – High level, strategic role – financing structure, acquisitions, new markets, etc.

- Controller – Overseeing financial reporting/close process, managing service provider relationships, budgeting.

- Financial Planning & Analysis – budgeting, analyzes market and industry data, develops and monitors Key Performance Indicators (KPI’s).

- Revenue Cycle/Receivables Clerk – transaction accounting for sales and collections, monitors and reconciles accounts receivable.

- Expense Cycle/Payables Clerk – transaction accounting for expenses, including matching vendor statements/invoices to purchase orders and receiving documents, monitors and reconciles accounts payable.

- General Accounting/Bookkeeping – handles general accounting, fixed assets, adjusting entries, reconciles bank statements, investments, etc.

- Tax and Regulatory Reporting – tax planning and projections, accounting for income taxes, tax reporting to various regulatory agencies (IRS, state income tax, sales tax, excise taxes, DOL, etc.)

- Compliance and Internal Audit – conducts internal risk assessments, creates and monitors controls, internal audits of risk areas.

- Director of Continuous Improvement – Design programs to develop, coordinate, teach and execute best practices that strategically and operationally improve business process and workflow.

- Most businesses have a need for expertise in each of these areas, but perhaps not full-time. As a result, they often hire a bookkeeper or accounting manager level person and have their CPA firm prepare the financial statements and tax returns. This structure has inherent limitations.

- Businesses of all types and sizes are becoming increasingly complex from an accounting and financial management perspective as to:

Who needs this service? Examples include:

- Medical practices

- Not-for-profit organizations

- Family-owned businesses

- Family office (high net worth individuals/families)

- Real estate management companies

- Large public/private companies

We can provide tailor-made solutions based on the scope of services your business needs, including:

- FULL-SCOPE CAAS (VIRTUAL ACCOUNTING DEPARTMENT)

-

Our full-scope CAAS solution enables our firm to serve as our client’s virtual accounting department, with the complete accounting/finance function being performed within our four walls. The foundation of our solution is centered on:

- A cloud-based technology platform consisting of an Enterprise Resource Planning (ERP) software solution, various integrated applications and bank/investment account interface. We select and customize the technology tools we use based upon our client’s needs.

- A streamlined process, through which financial data is aggregated, coded and accounted for.

- A browser-based system which allows our client and our team to access and communicate anywhere, anytime on multiple devices.

- Access to valuable financial information available in real time.

Our full-scope solution can essentially be broken down into five categories:

- Transaction processing

- Revenue cycle/accounts receivable

- Expense cycle/accounts payable

- Payroll coordination

- Business credit card analysis

- Controller level services

- Period-end closing of books/account reconciliations

- Customized financial reporting

- Dash-boarding to track KPI’s and other metrics

- Aggregation of data from multiple software platforms

- Available in real-time to allow for more informed evaluation and decision-making

- Key financial metrics

- Key operational metrics

- Financial planning and analysis

- Budgeting

- Projections (what/if analysis)

- Considers ROI for major purchases and investments

- CFO level services

- Involved in major decisions

- Consideration capital/debt financing, acquisitions/divestitures, etc.

As you go from transaction processing up to CFO level services, the value we can provide increases. Therefore, our strategy is to automate as much of the transaction processing as possible and spend more of our time providing higher value services. We accomplish this by utilizing the technology stack above and through assisting our clients with integrating the various software platforms they use in-house.

- CFO-LEVEL SERVICES

-

- Work directly with the business owner or organizational leadership team on strategic initiatives.

- Assists with succession planning, family dynamics

- Retirement planning, investment management

- Lead “Project Manager” for:

- Capital/debt financing

- Acquisitions

- Divestitures

- Other strategic initiatives

- CONTROLLER-LEVEL SERVICES

-

- Oversees the accounting function and client’s internal team

- Leads the monthly and annual close process

- Coordinates communications/action of other service providers (auditors, tax advisors, insurance representatives, investment managers, etc.)

- Involved in strategic initiatives (budgeting, financial analysis, etc.)

- ACCOUNTING STAFF-LEVEL SERVICES

-

- Services provided on a temporary or project basis

- BUSINESS PROCESS OUTSOURCING

-

- Dopkins Tax Advisory Group

- SALT specialist (Sales tax/Income tax planning & compliance)

- Virtual tax department (compliance, planning, staffing support)

- Dopkins Assurance Services Group

- Internal audit

- System Consulting

- System integration/automation

- Accounting system implementation (Sage Intacct)

- Business process design (technology focus)

- Dashboards/custom reporting

- Wealth Management

- Dopkins Clear View Solution

- Customized retirement plan design

- Fiduciary governance

- Transaction Advisory Services

- Financing Advisory Services

- Analyze Historical Financials & Planned Results

- Review Balance Sheet, Income Statements & Cash Flows

- Assess Needs vs. Sources

- Develop Financing Package

- Contact Financing Sources and Distribute Package

- Obtain and Evaluate Offer Letters

- Recommend Preferred Offer(s)

- Assist in Negotiating Transaction

- Track Lender Metrics or Milestones

- Transition into New Financing Arrangement

- Financing Advisory Services

- Dopkins Tax Advisory Group

- CONTINUOUS IMPROVEMENT SERVICES

-

- Assist in strategy development, prioritization and deployment

- Work with your team to facilitate process improvement projects:

- Coordinate project management

- Identify root cause problems

- Implement solutions

- Design efficient and improved workflow

- Provide Lean/Six Sigma training

Benefits to You

- The Right People: We serve you with a team that brings experience and expertise in all areas of the finance function focused on adding value to your business

- Real-Time Visibility: We provide dynamic dashboards and reports that give you a clear picture of your financial standing

- Connected Data: No more disparate data. We provide a best-in-class cloud platform that can integrate with other platforms

- Scalable Process and Controls: We implement proven processes and controls that accommodate growth, improve efficiency and reduce risk

For more information, please contact Albert Nigro at anigro@dopkins.com.