Research and Development (R&D) Tax Credit Services

Helping our clients achieve TAX SAVINGS, one activity at a time.

Did you know Research & Development expenses for your business may qualify as a nonrefundable tax credit?

If your company performs any of the following activities, such as, developing a new product, building prototypes, solving a product or process issue, improving a process, providing engineering services, or developing software, you may qualify for the R&D Credit, directly reducing the amount of tax owed to the Internal Revenue Service.

If your company performs any of the following activities, such as, developing a new product, building prototypes, solving a product or process issue, improving a process, providing engineering services, or developing software, you may qualify for the R&D Credit, directly reducing the amount of tax owed to the Internal Revenue Service.

Research & Development can occur at any level inside an organization and is often overlooked from an accounting perspective. This credit is available to organizations operating in a wide range of industries, providing a significant opportunity for savings to be passed back into your business for continuation of growth and strategic development.

>> While the calculations and qualifications can be rather complex, our professionals are passionate about helping you take advantage of incentives that directly impact your bottom line.

Download our Research and Development (R&D) Tax Credit Services brochure here.

Our Solution

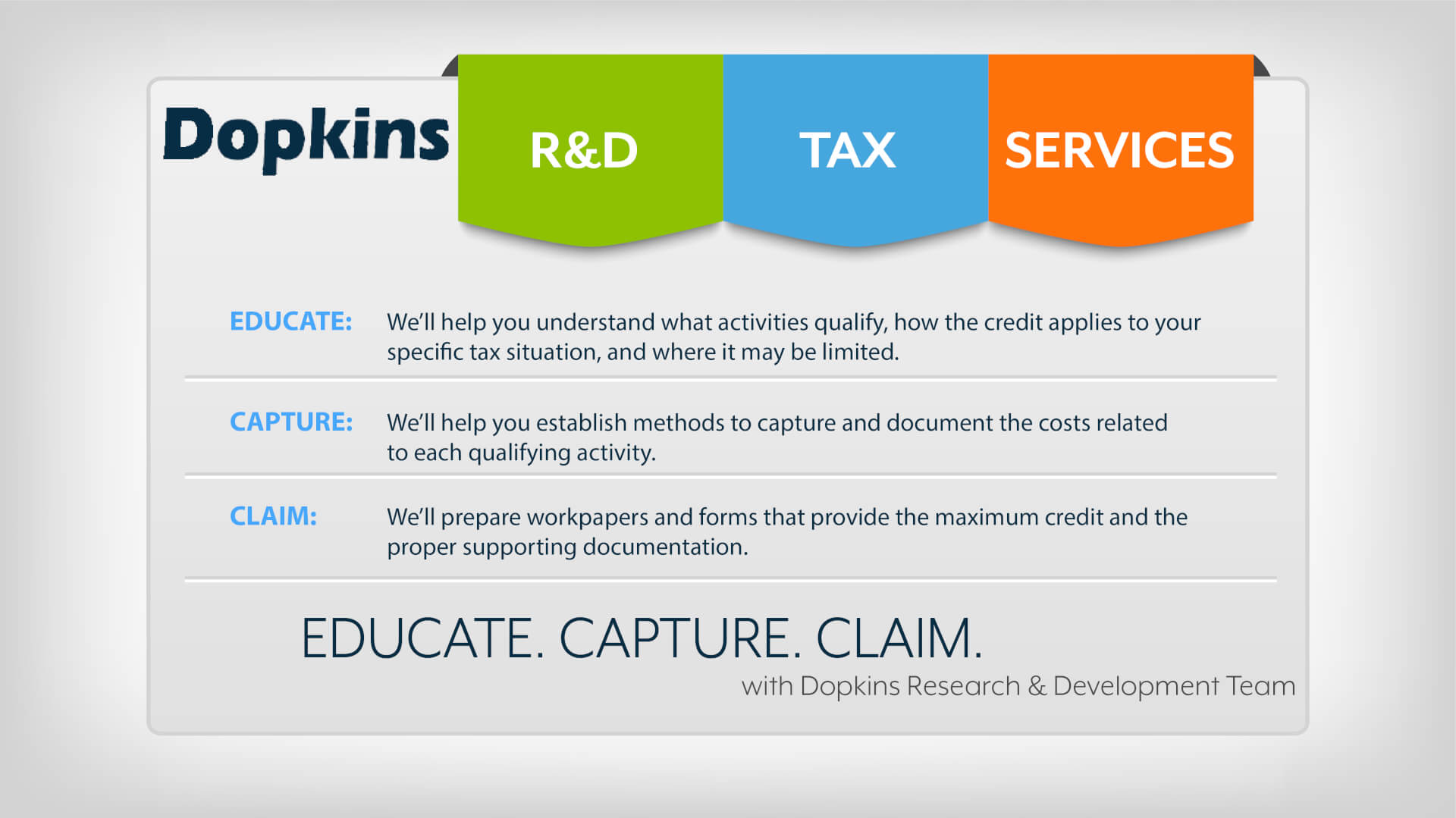

Recognizing the underutilization of this tax credit, the Dopkins R&D tax team has put together a program that accomplishes three tasks: EDUCATE, CAPTURE and CLAIM. We use our knowledge to work directly with your team, maximizing the credit based on your company’s unique activities.

What Industries Can Benefit from the R&D Tax Credit? Here are a few examples:

- Aerospace and Defense

- Architectural Services

- Automotive

- Construction

- Electronics

- Engineering Services

- Financial Services

- Food and Beverage

- Manufacturing

- Medical Devices

- Professional, Scientific and Technical Services

- Real Estate, Rental and Leasing

- Software Development

- Wholesale and Retail Trade

THE PROCESS: HOW DOES AN ACTIVITY QUALIFY?

A four-part test helps to determine qualified R&D activity.

Part 1: Permitted Purpose |

Part 2: Process of Experimentation |

Intended to develop or improve a product or processes:

Does NOT Include Aesthetics |

Designed to evaluate one or more alternatives to achieve a result through:

|

Part 3: Elimination of Uncertainty |

Part 4: Technological in Nature |

Addresses technical issues unknown at the outset of the project:

|

The activity must rely on principles of one of the following sciences:

Does NOT include Social, Economic or Psychological Sciences |