The Rise of Data Analytics Part III: The Data Analytic Technique – Benford’s Law

December 5, 2018 | Authored by Steven D. Szymanski, CPA

December 5, 2018 – If you’ve been following our blog chain on Data Analytics (where you can find more here: “The Rise of Data Analytics: Part I” and “The Rise of Data Analytics Part II: Benefits and Obstacles” then you may have been wondering about a practical technique. One technique which can be used over a mass set of data is Benford’s Law. Frank Benford, who gave the law its namesake, used mathematical expectations related to naturally occurring numbers to identify a trend. Here we can utilize this method to identify anomalies.

For a printable copy of this article, please click here.

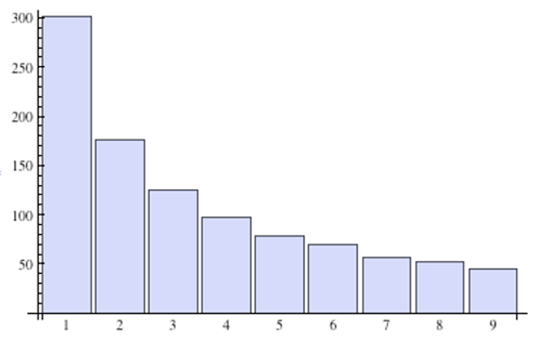

Benford’s Law is also known as the first-digit law. It’s an observation about the frequency distribution of digits in a data set. The law states that in many naturally occurring collections of numbers the leading digit is likely to be small (i.e., the first digit is more likely to be a low number compared to a high number or one versus two and two versus three). Statically speaking, the numeral 1 will be leading ~30.1% while the numeral 2 will be ~17.6% and each numeral after at a reducing percentage. See chart below for a visualization of Benford’s Law:

We previously noted this is a useful tool when considering approaches to fraud detection. For practicality, in an example of disbursements Benford’s law will be able to point out certain anomalies. While not all anomalies point to fraud, they could alert you to unusual activity that is worth investigating. The unusual activity could be an indication of improper approvals or potential exceptions like reoccurring fixed payments (which can be added to a list and built into the equation over time). This method can be extremely useful in cases where there are certain levels of approvals for disbursements. If there was a spike in transactions ending in 499 you may want to ask yourself “Is there an approval threshold of $500, $1500, or $2,500” that someone might be attempting to circumvent? As indicated in the natural occurrence of the digits, an unusual occurrence of certain types of transactions will easily stand out in a bar graph whether it’s related to the first, first – second, first-second-third digits, or even two decimal places (e.g., if there is an unusual amount of transactions ending in 00 this would also cause suspicion and require further investigation).

This is just one example of a procedure you can add to help your current risk assessment over a certain area. Stay tuned for our next blog on Data Analytics, and if you have any further questions on Risk Advisory Services please feel free to reach out or view more content here.

Dopkins & Company has a team of professionals experienced in utilizing data to assist you in understanding the “numbers” so that you can make informed decisions in a timely and efficient manner. Our team consists of professionals that help facilitate the process to identify key data points and leading indicators for your business. Our experts routinely assist with building automated processes to extract data in a timely, accurate and efficient manner. Contact us if you’re interested in exploring opportunities to improve your company’s use of data!

>> Read our full series of Data Analytics Blog Posts.

For more information, please contact Mark Stamer at mstamer@dopkins.com or Steven Szymanski at sszymanski@dopkins.com.

About the Author

Mark B. Stamer CPA

As a member of the Assurance Services Department, Mark primarily focuses on consulting services provide to a variety of the firm’s closely-held businesses. Mark helps streamline processes and provide management with financial information by researching, analyzing, and preparing financial statements. As a member of the Firm’s Forensic Accounting Group, he routinely assists in forensic accounting matters, litigation support services, and fraud prevention techniques.

About the Author

Steven D. Szymanski, CPA

Steven is a member of the Assurance Services Department, and provides clients with financial information by researching and analyzing accounts and preparing financial statements. He began his career with Dopkins System Consultants, where he offered clients a range of IT assurance and consulting services.