What Would a Recession Mean for Stock Returns?

June 27, 2023 | Authored by Ryan C. Smith CFP®

Takeaway: Investors who look beyond after-the-fact headlines about markets and the economy and stick to a plan may be better positioned for long-term success.

Recession concerns have been a fixture in the news lately, prompting many investors to wonder about what factors go into a recession announcement and how an economic downturn would impact their portfolios.

Recessions may understandably trigger worries over how markets might perform. However, investors should be aware that recession announcements are backward-looking, in contrast to the forward-looking nature of markets. Recessions are typically determined using macroeconomic indicators such as employment rates, consumption and income data, and gross domestic product growth—information that is rapidly incorporated into market prices. In fact, recessions are often officially declared after the market is already on the path to recovery.

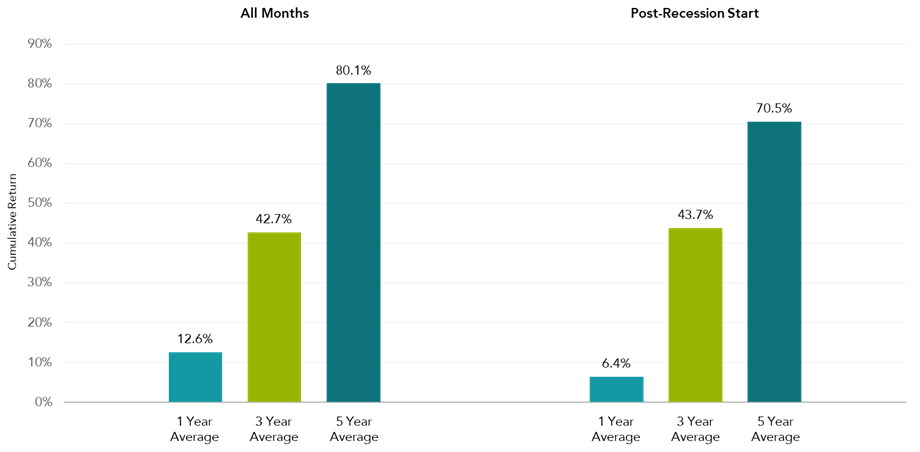

Consistent with forward-looking expectations, average US equity returns have been positive after the onset of a recession, as seen in Exhibit 1 below.

Returns data based on monthly S&P 500 Index returns from January 1947 to December 2022. Returns are calculated for the 1-, 3-, and 5-year look-ahead periods for all months and post-recession start months. The sample start date is based on quarterly US gross domestic product data, a key measure used to identify changes in economic activity across the business cycle, that is first available starting in 1947. Business cycle recession dates sourced from the National Bureau of Economic Research (NBER). S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Exhibit 1 shows that the S&P 500 Index had positive average returns following recession start dates that were similar to overall averages across 1-, 3- and 5-year time horizons in the period 1947–2022. The historical data suggests that investors can benefit from a disciplined approach that avoids making investment decisions based on lagged economic outcomes.

In short, history shows that markets incorporate expectations ahead of the news.

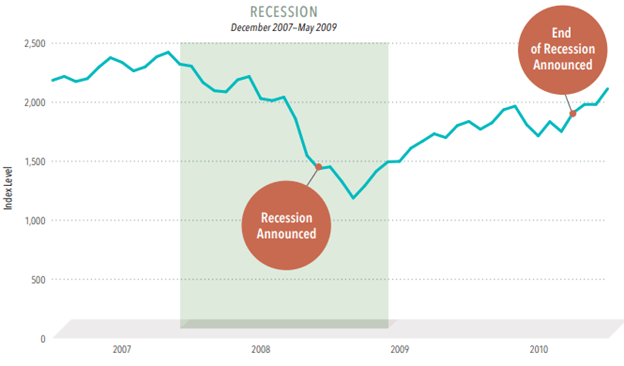

As an example, look back to the global financial crisis. The official “in recession” announcement came in December 2008—a year after the recession had started. By then, stock prices had already dropped more than 40%.1 Although the recession ended in May 2009, the announcement came 16 months later, by which time US stocks had rebounded.

In US dollars. S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Start and end dates of US recessions, along with announcement dates, are from the National Bureau of Economic Research (NBER).

Investors who look beyond after-the-fact headlines about markets and the economy and stick to a plan may be better positioned for long-term success.

For more information, contact Ryan Smith at rsmith@dopkins.com.

* Dopkins Wealth Management, LLC is a registered investment advisor owned by the partners of Dopkins & Company, LLP.

Source: 1 Stock price decline of more than 40% from December 2007–December 2008 is based on the S&P 500 Index’s price difference between the actual start of the recession in December 2007 and the official “in recession” announcement 12 months later.

About the Author

Ryan C. Smith CFP®

Ryan provides financial solutions to individuals, trusts and businesses. His services include guidance to clients regarding financial planning, investments and portfolio analysis.