What Happens When You Fail at Market Timing

December 17, 2019 | Authored by Ryan C. Smith CFP®

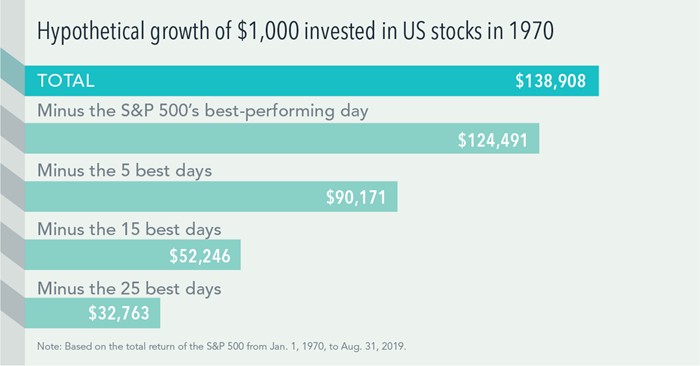

December 17, 2019 – The impact of missing just a few of the market’s best days can be profound, as this look at a hypothetical investment in the stocks that make up the S&P 500 Index shows. A hypothetical $1,000 turns into $138,908 from 1970 through the end of August 2019. Miss the S&P 500’s five best days and that’s $90,171. Miss the 25 best days and the return dwindles to $32,763. There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst—so history argues for staying put through good times and bad. Investing for the long term helps to ensure that you’re in the position to capture what the market has to offer.

The missed best day(s) examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best day(s), held cash for the missed best day(s), and reinvested the entire portfolio in the S&P 500 at the end of the missed best day(s). Annualized returns for the missed best day(s) were calculated by substituting actual returns for the missed best day(s) with zero. Performance data for January 1970-August 2008 provided by CRSP; performance data for September 2008-August 2019 provided by Bloomberg. S&P data provided by Standard & Poor’s Index Services Group. Indices are not available for direct investment. Past performance is no guarantee of future results.

For more information, contact Ryan Smith at rsmith@dopkins.com.

Disclosures

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

* Dopkins Wealth Management, LLC is a registered investment advisor owned by the partners of Dopkins & Company, LLP.

About the Author

Ryan C. Smith CFP®

Ryan provides financial solutions to individuals, trusts and businesses. His services include guidance to clients regarding financial planning, investments and portfolio analysis.