The Election and the Market

August 27, 2020 | Authored by Ryan C. Smith CFP®

Published August 27, 2020 – On November 3rd, millions of Americans will cast their vote for the next President of the United States. Although the outcome of the election is uncertain, one thing we can count on is that plenty of opinions and prognostications will be floated in the months leading up to Election Day. In financial circles, this will almost assuredly include perceptions and opinions of market impacts. But, should long-term investors focus on presidential elections?

Return Over the Years

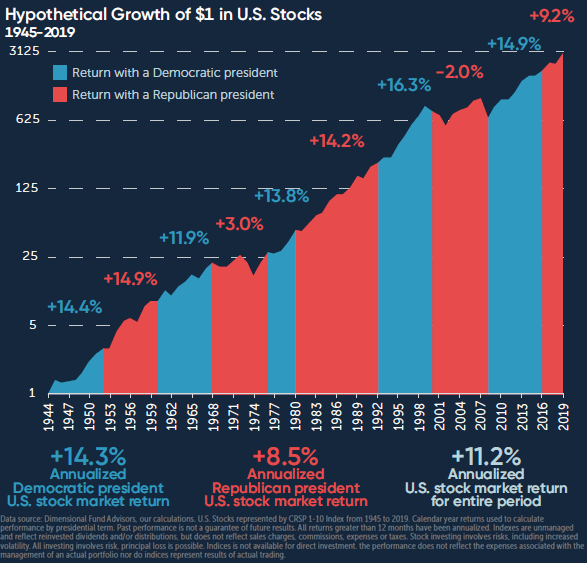

When compared against your overall investment horizon, a single presidential term is relatively brief. A single election cycle barely registers as a blip on the radar. The emotions that come with these events, however, can be expansive, consuming, visceral. We hope to put the campaign season between now and November into some financial perspective, because as the data shows, whoever is in the White House does not preordain doom or boom for stock returns. We see that both parties have periods of strong growth and sharp declines during their time, however, there does not appear to be a pattern of stronger returns when any specific party is in office. The key takeaway is that markets have historically continued to provide positive returns over the long run irrespective of which party is in the oval office.

When compared against your overall investment horizon, a single presidential term is relatively brief. A single election cycle barely registers as a blip on the radar. The emotions that come with these events, however, can be expansive, consuming, visceral. We hope to put the campaign season between now and November into some financial perspective, because as the data shows, whoever is in the White House does not preordain doom or boom for stock returns. We see that both parties have periods of strong growth and sharp declines during their time, however, there does not appear to be a pattern of stronger returns when any specific party is in office. The key takeaway is that markets have historically continued to provide positive returns over the long run irrespective of which party is in the oval office.

Markets Have Already Priced in the Possibility of a Biden Presidency

Right now, if you look at the odds-on betting markets, the consensus estimate is that Biden has about a 55% chance of winning the election, while Trump has about a 40% chance. The remaining 5% is allocated to various candidates and non-candidates. What will wind up moving financial markets is if conditions change such that the odds of Biden becoming president significantly increase or decrease. President Trump was a heavy underdog in 2016; betting markets gave him just a 20% chance of winning the day before the election. And yet, even after the surprise outcome, market moves were relatively muted the day after the election (the S&P 500 was up 1.1% that day).

Two-Step Forecasting is Difficult

Two-step forecasting is when someone says, “I forecast X, and as a result Y will happen.” Let’s say you’re 60% sure Biden is going to win (which is roughly in line with the consensus estimate). Let’s also assume that you’re 60% sure a Biden victory means stocks will decline in value. Then assume that if you’re wrong and Trump wins (a 40% chance) there’s another 30% possibility that stocks will decline for other reasons.

Keep in mind that going back to 1926, the S&P 500 has had negative returns in 27% of calendar years, so these assumptions are essentially saying that a Biden presidency is more than twice as likely to cause a stock market decline as has happened historically, while a Trump presidency means that the chances are roughly the same as history.

Using the above assumptions, the math works out on this so that there is a 36% probability (60% x 60%) that you’re right about Biden winning and then also right about the market declining as a result, plus another 12% probability (40% x 30%) that you’re wrong about Biden winning but accidentally right about the market decline anyway. This totals out to a 48% chance of getting your two-step forecast correct, or essentially a coin-flip.

Your Political Views Can Lead to Investing Mistakes

There’s actually evidence that election results have the power to affect how investors handle their portfolios. The 2010 study “Political Climate, Optimism, and Investment Decisions” examined the link between investors political affiliations and their investment choices. Simply put, when your political party is in power, you feel much more confident about the economy and markets, and vice versa.

There’s actually evidence that election results have the power to affect how investors handle their portfolios. The 2010 study “Political Climate, Optimism, and Investment Decisions” examined the link between investors political affiliations and their investment choices. Simply put, when your political party is in power, you feel much more confident about the economy and markets, and vice versa.

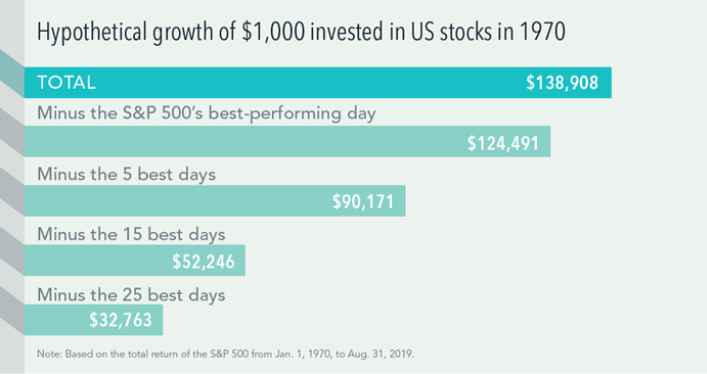

Being aware of your biases can help you make better investment decisions. Trying to time the market due to concerns about the upcoming election is not likely to be a winning strategy. The reason is that you have to be right not once, but twice. In order for market timing to work, you need to know when to get out and when to get back in. Suppose you get out now. Do you get back in if Trump wins? If, Biden wins, do you stay out of the market for four full years waiting for the 2024 election? The bottom line is that you shouldn’t let the latest economic or political news cause you to abandon your well-developed plan.

Closing Remarks

It is natural to draw a connection between the administration in power and the influence they may have on markets. However, we would caution investors against making short-term changes to a long-term plan to try to profit (or avoid losses) from changes in the political landscape. Stock market performance, when grouped by presidential party, historically, doesn’t tell the whole story (remember, correlation is not causation). Our political beliefs can color how we see the world around us, whichever party is in power, and influence our investment decisions, often with less-than-ideal financial results.

Equity markets can help investors grow their assets and we believe investing is a long-term endeavor. Predicting election results as a way to alter one’s portfolio is unlikely to result in reliable excess returns for investors. At best, any positive outcome based on such a strategy will likely be the result of random luck. At worst, it can lead to a costly mistake. The main takeaway from this data and commentary is that you are best served by looking past the upcoming election and focusing on the long term.

For a printable copy of this article, please click here.

For more information, please contact Ryan Smith, Investment Advisor, Dopkins Wealth Management, LLC*, at rsmith@dopkins.com.

* Dopkins Wealth Management, LLC is a registered investment advisor owned by the partners of Dopkins & Company, LLP.

Disclosures & Data source: Dimensional Fund Advisors, our calculations. U.S. Stocks represented by CRSP 1-10 Index from 1945 to 2019. Calendar year returns used to calculate performance by presidential term. Past performance is not a guarantee of future results. All returns greater than 12 months have been annualized. Indexes are unmanaged and reflect reinvested dividends and/or distributions, but does not reflect sales charges, commissions, expenses or taxes. Stock investing involves risks, including increased volatility. All investing involves risk, principal loss is possible. Indices is not available for direct investment. the performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

About the Author

Ryan C. Smith CFP®

Ryan provides financial solutions to individuals, trusts and businesses. His services include guidance to clients regarding financial planning, investments and portfolio analysis.