ETF or Mutual Fund? Which is Right for You?

May 27, 2021 | Authored by Ryan C. Smith CFP®

Published May 27, 2021 – ETFs (exchange-traded funds) are often compared and contrasted with mutual funds. As ETFs continue to gain popularity among their mutual fund counterparts, it is important for investors to know the nuances of each investment vehicle.

In this article, we highlight key considerations that may be important to investors evaluating which vehicle to choose, such as implications for tax efficiency, the differences in how mutual funds and ETFs are bought and sold, and the types of costs encountered when investing in the two vehicles.

How are ETFs and mutual funds alike?

Both ETFs and mutual funds have a similar structure.

The two investment vehicles are made up of individual securities, like stocks and bonds, to form a “basket” or “pool” of investments.

ETFs and mutual funds both offer exposure to a wide variety of asset classes and niche markets. A diversified portfolio can be created by using one of the two options. Since the vehicles are made up of multiple investments, they generally provide more diversification than a single stock or bond.

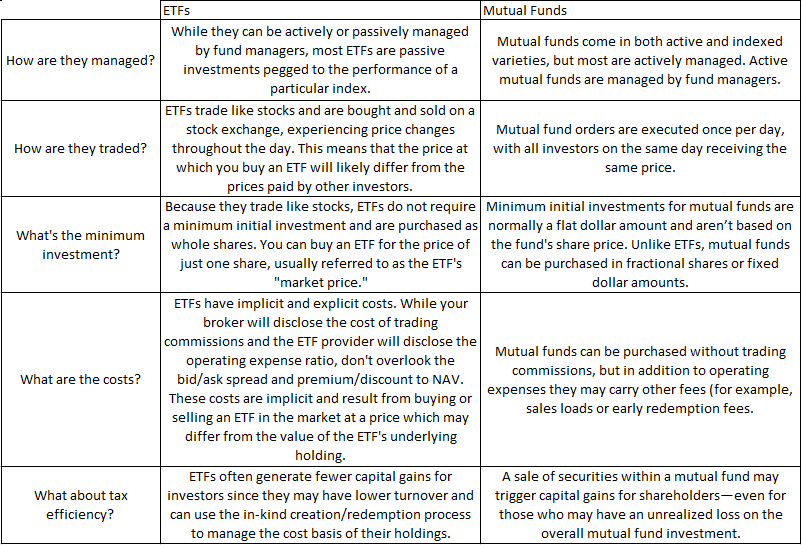

How are ETFs and mutual funds different?

ETF or mutual fund? Which is right for you?

That all depends on your goals and the type of investor you are. The decision to invest in a mutual fund versus an ETF depends in part on an investor’s preference for one vehicle type over the other.

An investor may want to consider an ETF if they are an active trader. This includes intraday trades, stop orders, limit orders, options, and short selling. An ETF provides trading flexibility to accommodate all of these trades, whereas, a mutual fund cannot.

An ETF may be used for tax sensitive situations. In general, ETFs tend to be more tax efficient than index mutual funds.

An investor may want to consider a mutual fund if they invest frequently. Examples of this include dollar-cost-averaging or making regular deposits into an account. Mutual funds give the ability to purchase fractional shares to the investor. This means an investor can purchase the same dollar amount each time they invest, therefore, letting no dollar go to waste.

A mutual fund may be used when a similar ETF is thinly traded. When you buy or sell ETF shares, the price may be less than the net asset value (NAV) of the ETF. The difference (“bid/ask spread”) is often insignificant, but for less actively traded ETFs, that might not always be the case. The investor must cover the “bid/ask spread” incurring an additional cost. By contrast, mutual funds always trade at NAV, without any “bid/ask spreads”, avoiding that cost.

In sum, in either an ETF or mutual fund, Dopkins Wealth Management invests with an investment philosophy based on academic evidence. Offering both vehicle structures allows investors to choose the vehicle most suitable for their unique circumstances. As always, there exists a risk of loss with any investment. You should consult with your investment advisor before making any decisions. Dopkins Wealth Management can help you achieve your investment goals.

For a printable copy of this article, please click here.

For more information, contact Ryan Smith at rsmith@dopkins.com.

* Dopkins Wealth Management, LLC is a registered investment advisor owned by the partners of Dopkins & Company, LLP.

1 Source: Investing with Dimensional in a Mutual Fund versus Exchange-Traded Fund

2 Source: ETFs vs. Mutual Funds – What’s the Difference? | Charles Schwab

About the Author

Ryan C. Smith CFP®

Ryan provides financial solutions to individuals, trusts and businesses. His services include guidance to clients regarding financial planning, investments and portfolio analysis.