Coronavirus Aid – Year End Reporting and Strategy for Healthcare

November 23, 2020 | Authored by Nicholas Fiume CPA

Published November 23, 2020 – It has been a long year, but as the end of 2020 approaches, many organizations are looking to the accounting and reporting implications of the Coronavirus pandemic.

For managers of healthcare entities, you were on the front lines of an unprecedented public health response. Back in March and April, the focus was rightly on what needed to be done for the health and safety of your providers, employees and patients. Significant changes were made, significant costs were incurred and a shift to minimize elective procedures initially caused volume to plummet. As the months went on, certain sectors of healthcare experienced growth that strained capacity. As I write today (November 9), Pfizer has announced promising vaccine trial results. With hope that light at the end of the tunnel may be in sight, the difficult, but necessary, task of accounting for the pandemic needs to occur.

The CARES Act and related legislation provided significant aid and stimulus to businesses across all industries. As we discuss in our blog What’s Your Year End Strategy for CARES Act Funding?, for entities that received government aid, especially the Paycheck Protection Plan (PPP) loans, there are several strategic considerations to year-end choices on the timing of financial statement recognition and allocation of expenses.

For a printable copy of this article, please click here.

For healthcare entities, things are even more complex – as nearly all participated in the Department of Health and Human Services Provider Relief Fund (PRF), many submit cost data to state and federal regulators which can influence future rates, and, by nature of what they do, they incurred more costs and impacts from COVID-19 than nearly all other business types.

So, what to do now?

As a caveat, the information in this blog is based on our current understanding as of November 9, 2020. As has been the case since March, government regulators continue to revise rules and program guidelines – often reversing prior positions.

Understanding the Common Programs – PPP and PRF

Many healthcare entities which qualified as eligible small businesses received funding from both the Small Business Administration’s PPP program and Health and Human Services PRF program.

Several articles explaining details of PPP are available at Dopkins & Company’s COVID-19 Business Resource Center and basics of PRF were covered in our blogs Update on Healthcare Industry Relief and Compliance Audit Requirements for Healthcare CARES Act Recipients.

As a quick overview:

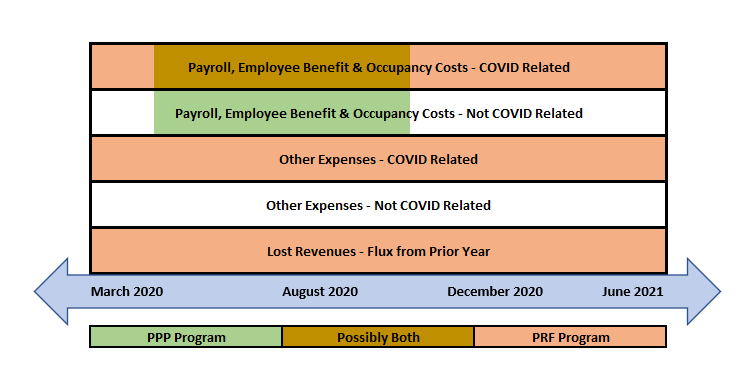

- PPP provided a forgivable loan equal to two-and-a-half months typical payroll expense. Forgiveness can be earned by incurring payroll, employee benefit and certain occupancy costs during the 24-week period after the loan was made. Notably, the eligible expenses are defined by type, but do not necessarily need to be related to COVID or pandemic response.

- PRF was a grant, for most entities approximating 2% of annual patient service revenue. Funds from the grant may be used to cover extra expenses and lost revenue related to the pandemic response up until June 30, 2021. The definition of extra expenses and lost revenue was vague at the time most funds were disbursed, but definitions, and reporting and audit requirements were later released (and have been revised a few times).

The different time periods and eligible expenses for the two programs makes classifying extra expenses and lost revenue important:

Layered Complexity – Grants and Cost Reporting

In addition to PPP and PRF, thinking about classification of expenses and their financial impacts gets more complex when you layer on grants and cost reports.

While few state agencies and payors have finalized regulations or methodologies for how to treat PPP or PRF dollars in 2020 cost reporting, there is a likelihood that there will be some attempt to prevent double-dipping. A grantor or government agency will want to avoid reimbursing through rates what has already been reimbursed through the CARES Act. While in many ways that is common sense, there is risk for healthcare entities that rates are often prospective and may have ongoing impact in future years, when there is no further Coronavirus relief.

To the extent that the eligible expenses for PPP or extra expenses and lost revenue for PRF exceed the funding received, there may be an opportunity for strategy in which specific expenses are claimed for reimbursement – particularly if those expenses “left in the pool” can be eligible costs for other programs.

Application, Reporting and Audit Requirements

Many healthcare entities have a few dates coming up by when they need to make certain decisions or gather information:

- PPP Forgiveness Applications are beginning to be accepted by many banks, and, unless the PPP loan was received extremely late, nearly all would by now be past the 24-week period for incurring eligible expenses. Thus, the information needed and opportunity to file is likely already here. That said, PPP borrowers have 10 months from the end of the 24-week period to apply before loan payments are due (and forgiveness can still be sought right up until the loan’s maturity), so you have until mid-2021 before the lack of submission has consequences.

- PRF reporting on eligible expenses and lost revenue for calendar year 2020 is currently due on February 15, 2021. For many entities, this will be the first deadline where they need to be “pencils down” on allocating certain expenses as covered by PRF. Under current guidance, this reporting, which may be self-prepared by management / does not require independent attestation, will ask you to summarize “healthcare related expenses attributable to coronavirus that are not reimbursed or obligated to be reimbursed from other sources” in the categories of general and administrative (G&A) and healthcare related expenses. Entities which received more than $500,000 will need to use more detailed categories. If expenses do not fully utilize your received funds, you may also report lost revenue – currently defined as your actual 2020 patient care revenue less actual 2019 patient care revenue.

- Audited financial statements – depending on the banking agreements you may have or the regulators with whom you have reporting requirements, audited financial statements are typically due for healthcare entities between 90 and 150 days after year end. If you have an audit requirement, you will need to address in those financial statements your accounting for PPP forgiveness and whether you believe you have deferred revenue or a contingent liability for the return of funds received. Because tax returns and cost reports generally require agreement or reconciliation to audited financial statements, the decisions made here can have a binding impact.

- PRF Second Report – While not required if you accounted for all of your PRF funds in calendar 2020, if you had funds left over, you have until June 30, 2021 to continue incurring expenses and lost revenue. The final report, in similar format to the February 15 report described above, is currently due July 31, 2021

- Uniform Grant Guidance (UGG) audits – If your total federal funds received from all federal sources other than the PPP program exceeded $750,000, you are likely required to include PRF (and other programs) in a federal compliance audit. Such audits are generally due 9 months following year end (September 30 for calendar years). For many healthcare entities who routinely are subject to UGG audits, the PRF will constitute a new major program. For those crossing the $750,000 threshold for the first time, this may be an entirely new requirement. A federal compliance audit focuses on whether you followed the rules for a given federal program – including allowable costs and meeting documentation and reporting requirements. For the PRF program, this may be a challenge as the “rules” were being released as operations were ongoing. Details on the specific compliance requirements are not yet known.

What can you do now?

While this is complex, and details continue to be fleshed out, there are steps that healthcare entities can take now.

The first, and most important, is to make sure that you have a full and complete inventory of your COVID-19 related extra expenses and lost revenue. Make this detailed and categorized. Think about lost revenue both in terms of variance to last year (the PRF current rule) as well as in a broader sense of estimated impact of COVID (taking into account revenue growth that would have been expected to occur absent COVID). Think about both direct, obvious costs of COVID (masks and PPE, facility changes, IT costs for a new remote workforce), but also indirect costs of management oversight, overtime, etc. These may not all be eligible for every program but having a complete population of impact will help you to understand what may be eligible for the various programs you do have.

Once you have your data, you are in a position to begin strategizing:

- Which costs and lost revenues fit best with which funding sources?

- Do we want to file forms as soon as possible or wait?

- Do our accounting choices in one place (audited financial statements or what expenses we included in a PPP application or first submission for PRF) limit our options or bind our position in cost reports or tax filings?

We are here to help

Healthcare finance was already complicated before COVID – and many teams were stretched thin. With hundreds of thousands or millions at stake, it is important to be confident in your strategy. Dopkins & Company can help you to work through the options, with a team of experts closely following the rules as they develop. If you need help getting started, we are just a call or an e-mail away.

For more information, contact Nicholas Fiume at nfiume@dopkins.com.

About the Author

Nicholas Fiume CPA

Nick is the Leader of Dopkins Healthcare and Not-for-Profit Practices. He provides assurance and consulting services to clients from a diverse mix of industries, including health care providers, hospitals, health and life insurance, charities and tax exempt organizations, manufacturing and financial services.