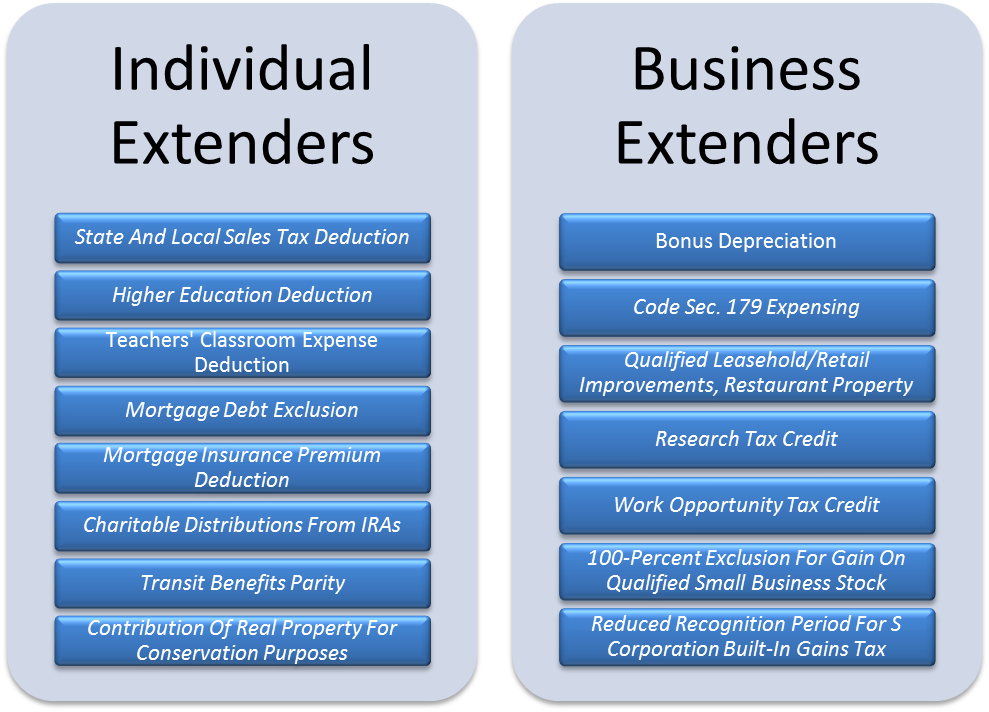

Congress Passes Extenders Package

December 17, 2014 | Authored by Eric R. Soro CPA

Have Questions?

We’re here to help. Please don’t hesitate to contact Eric Soro at esoro@dopkins.com or your Dopkins Tax Advisor.

About the Author

Eric R. Soro CPA

Eric, embraces the challenges of taxes and puts them to work for the client. He focuses on every aspect of a client's needs, from preparing top-level corporate and partnership returns through to the culmination of member and shareholder individual returns. Taking into account the ever changing tax laws, Eric researches the complex topics that affect his client's taxes so that he may efficiently plan his process and yield the optimal results. He joined Dopkins as an intern in 2006 then full-time in 2007 upon graduation.