A Disciplined Approach to Investing is No Gamble

February 24, 2021 | Authored by Ryan C. Smith CFP®

Published February 24, 2021 – A recent flurry of return spikes for a handful of US stocks has captivated investors and non-investors alike. In light of recent events, Wall Street news trending on social media amid extreme weather, sports, and COVID is indeed an unusual event. The past month filled was filled with trading frenzies, speculation, and the rise of retail investors. With all of the dramatic price movements in the market and all of the “latest and greatest” investments it is important to discuss why investing in the stock market is certainly not gambling.

It should come as no surprise that the biggest football game of the year ranks as one of the most popular events to gamble on. The American Gaming Association estimated that over 23 million people in the US wagered around $4.3 billion on the big game1. It should also come as no surprise that some of the money wagered will be lost, as the old adage goes ‘the house always wins.’

Recent speculative events in the financial markets have provoked many to question if investing in the stock market is akin to gambling. While there may be similarities, such as the risk of losing money, the probabilities of having a positive experience in the stock market are much greater than traditional gambling, especially when you take a long-term approach.

When you buy a stock, you become an owner of that company and are entitled to a claim on earnings and dividends into perpetuity. Stock prices fluctuate based on new information and the expectations of companies to generate profits, and prices settle at a level where there is a positive expected return. When you gamble, money is simply transferred from one party to another and no value is created, but odds are generally stacked against the players.

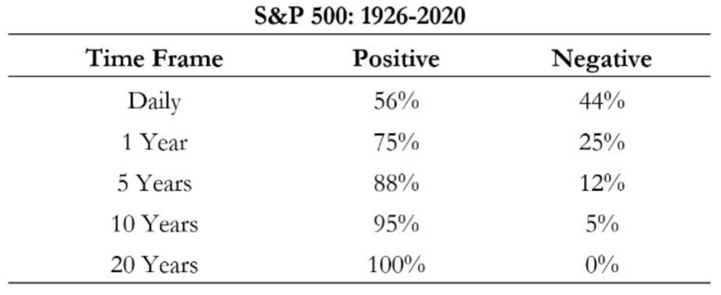

The below chart illustrates the historical outcome of success when investing in the stock market, using the S&P 500 as a proxy2. Even over the shortest time period, 1-day, there has been a 56% chance of achieving positive returns. As you extend the time frame the probability of earning positive returns in the market increases.

The longer you sit in a casino the greater the odds you’ll walk out losing, the longer you stay invested in the stock market, historically, the greater the probability you’ll experience positive outcomes. Unlike gambling, we believe the house is on the investor’s side when taking a disciplined, long-term approach to investing.

When stock prices are fluctuating and you’re thinking of buying on whims of a quick gain, we offer up a piece of advice.

What hasn’t generally benefited investors is attempting to outguess markets and identify mispriced securities. The degree of difficulty in anticipating market movements more quickly and effectively than the millions of other market participants is consistent with the scarcity of professional investment managers that have been able to outperform passive benchmarks. For investors, this means time is probably better spent scrolling past the news on stock price spikes and enjoying the comfort of long-term investing.

For a printable copy of this article, please click here.

For more information, contact Ryan Smith at rsmith@dopkins.com.

* Dopkins Wealth Management, LLC is a registered investment advisor owned by the partners of Dopkins & Company, LLP.

1Source: The Lines: How Much Money Will Be Bet on the Super Bowl In 2021?

2Source: Dimensional Fund Advisors. Thiis information is provided for registered investment advisors and institutional investors and is not intended for public use. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Past Performance is no guarantee of future results. Indices are not available for direct investment.

Copyright 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

About the Author

Ryan C. Smith CFP®

Ryan provides financial solutions to individuals, trusts and businesses. His services include guidance to clients regarding financial planning, investments and portfolio analysis.