A Disciplined Approach to Investing During the Economic Downtown

May 5, 2020 | Authored by Chad R. O’Connell AIF

May 5, 2020 – It’s true, sudden market downturns can be unsettling. However, it’s a fallacy to think you can wave the white flag, get out of the market, and jump back in “when the time is right.”

All too often, undisciplined investors jump ship and sell out of stocks during market downturns. It’s reasonable to think that getting out of a falling market can help investors avoid losses. One issue with this approach is the best days throughout history have generally come in the midst of significant market downturns.

In March we experienced the fastest bear market ever with stocks falling by more than 30%1. In that wild month of March, we also experienced the largest three-day surge in the Dow Jones Industrial Average since 19312! Following up on the roller-coaster ride that was March, in April we saw both the S&P 500 and the Dow Jones Industrial Average deliver their best monthly performance since 19873. If you were out of the market during this rebound, you may have missed out on a potential recovery from the earlier downturn.

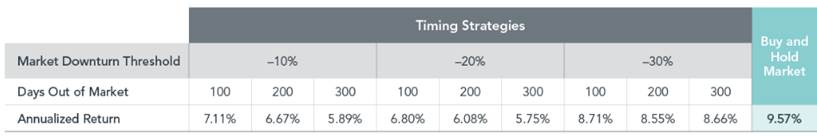

The data suggests that attempting to time the market may reduce investors’ gains over time. Our research partners at Dimensional conducted simulations using hypothetical timing strategies that switch from US stocks into US Treasury bills after market downturns of various magnitude and switch back to US stocks following different lengths of time out of the market. Compared to the market’s long-term annualized return of 9.57%, nearly all of the timing strategies underperform the simple buy-and-hold strategy.

Investors don’t need the added stress of trying to time markets to have a positive investment experience. Over time, capital markets have rewarded investors who have taken a long-term perspective and remained disciplined in the face of short-term noise. By focusing on the aspects within their control (like having an appropriate asset allocation, diversification, and managing expenses, turnover, and taxes) investors may be better positioned to capture the potential rewards of the capital markets.

For a printable copy of this article, please click here.

For more information, contact Chad O’Connell at coconnell@dopkins.com or your Dopkins Wealth Management, LLC advisor.

* Dopkins Wealth Management, LLC is a registered investment advisor owned by the partners of Dopkins & Company, LLP.

Performance shown is hypothetical and for illustrative purposes only. The performance was achieved with the retroactive application of a model designed with the benefit of hindsight; it does not represent actual performance, and it does not take into account any individual investor circumstances. Hypothetical performance does not reflect trading in an actual portfolio and may not reflect the impact that economic and market factors may have had on trading decisions. Market represented by Fama/French Total US Market Research Index. Details on the index can be found on Ken French’s website: http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html. Downturns are defined as the first instance of a cumulative return meeting the -10%, -20%, or -30% threshold following a day when the index has reached a new all-time high level. Timing strategies switch from the US stock market (represented by the Fama/French Total US Market Research Index) to One-Month US Treasury Bills (represented by the IA SBBI US 30 Day TBill TR USD provided by Ibbotson Associates via Morningstar Direct) following each downturn and switch back to the market following the number of trading days denoted. Past performance is not a guarantee of future results. No costs included.

About the Author

Chad R. O’Connell AIF

Chad manages Dopkins’ retirement plan services group, which focuses on investment management, consulting and fiduciary governance services to corporations and not-for-profit entities. In addition, Chad also provides financial services to high net worth individuals and business owners.