HOUSE VS SENATE: The Battle for Tax Reform Begins

November 15, 2017 | Authored by Dopkins Tax Advisory Group

November 17, 2017 – the Senate has modified their version to allow the proposed Individual tax cuts to expire in 7 years (2025).

November 16, 2017 – the House has passed their version of the Tax Cuts and Jobs Act by a vote of 227-205.

The Senate Committee on Finance released their own version of the Tax Cuts and Jobs Act on November 9, 2017. While there are similarities, the Senate has decided to do its own thing in some very significant ways. In the meantime, the House bill came out of “markup” with a few changes to their version.

Below we have compared some of the major items between the two competing bills.

INDIVIDUAL DIFFERENCES

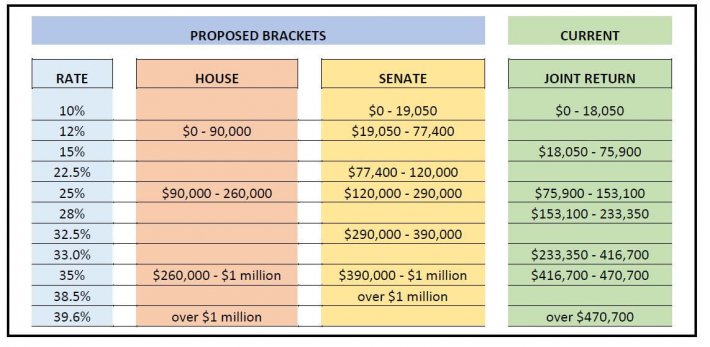

TAX RATES:

Ordinary Income: Senate proposes 7 tax rates, House just 5. For example, for married filing joint the rates fall as follows:

Qualified dividends and capital gains: No changes by the Senate or the House

Alternative Minimum Tax: Eliminated in both.

ACA individual mandate: Senate proposes to eliminate the health insurance requirement, House has no change from current law.

DEDUCTIONS AND EXEMPTIONS:

Retirement contributions: Senate matches the contribution limits for the different types of plans and eliminates catch-ups for wage earners over $500,000, House keeps the contributions the same as current law but eliminates the Roth recharacterization rule.

Student loan interest: Senate has no change from current law, House eliminates it.

Standard deductions for Single, Head of Household, and Married Filing Joint: the two versions differ by only a few hundred dollars ($12,000, $18,000, $24,000 for Senate, $12,200, $18,300, $24,400 for House).

Personal exemptions, the exemption phase-out, and some other additional standard deductions: Eliminated in both.

Medical expenses: Senate has no change from current law, House eliminates it.

Home mortgage interest: Senate has no change from current law for purchase debt, House limits qualified purchase debt to $500,000 going forward. The interest deduction on home equity debt is eliminated by both.

State and local income and sales taxes: Eliminated in both.

Real estate taxes: Senate eliminates it, House allows up to $10,000 as a deduction.

CREDITS:

College tax credits: Senate has no change from current law, House consolidates all into one AOTC credit.

Child and family tax credits: Senate raises the child tax credit to $1,650 and creates a $500 non-child dependent credit, House raises the child tax credit to $1,600 and creates a $300 non-child dependent credit.

Adoption and earned income tax credit: No changes to current law in Senate or House versions.

ESTATE TAX DIFFERENCES

Senate bill would double the exemption for individuals to $10 million each, House doubles the exemption until 2025 when it eliminates the tax entirely.

BUSINESS DIFFERENCES

TAX RATES:

C Corporation ordinary income: Senate proposes a 20 percent flat rate beginning in 2019, House allows for the same rate but beginning in 2018.

Pass-through ordinary income: Senate provides for a 17.4% deduction of pass-through or sole proprietor income, House proposes a 25% rate (9% rate for certain small businesses under $150,000 income) on a percentage of pass-through income based on a proposed calculation. Both versions eliminate the preferential treatment for certain service providers.

Alternative Minimum Tax: Eliminated in both.

DEDUCTIONS AND CREDITS:

Dividends received deduction: Senate has no change from current law, House reduces the deductions from 80% and 70% to 65% and 50%.

Capital investments: Senate and House would allow immediate expensing of qualified property for 5-year period. Senate increases Section 179 expense limit to $1 million with a phase out at $2.5 million, House increases the limit to $5 million with a $20 million phase out.

Interest expense: Both Senate and House cap the deduction for net interest expense at 30% of net income with an exception for small business.

Section 199 domestic production activities deduction: Eliminated in both.

Like kind exchanges: Eliminated in both for everything except real estate.

Research and development credit: Senate has no change from current law, House keeps the credit but requires a capitalization of all R&D expenses not taken as a credit with a 5-year amortization of the domestic expenses and 15-year amortization of the foreign.

INTERNATIONAL DIFFERENCES

Repatriation: Senate taxes a portion of the deferred overseas-held earnings and profits at a 10% rate for liquid and 5% rate for illiquid holdings. House version changes the rates to 14% and 7% respectively.

Foreign tax credits: Under both plans the carryforwards would remain available. Any foreign tax credits created by the deemed repatriation would only be partially available to offset any US tax.

The House is expecting to vote on their version of the bill sometime in the next few days. The Senate has scheduled the “markup” for theirs to occur this week so there will be changes. If both the House and the Senate pass their respective final bills, there will need to be a “Meeting of the Minds” to reconcile the two before any tax reform can become the Law of the Land. Who will be the final Winners and Losers remains to be determined. Only time will tell.

About the Author

Dopkins Tax Advisory Group

Our tax professionals include specialists who are proactive, strategic thinkers who work to maximize your cash flow. In addition to cash flow considerations, we also believe that tax planning is most effective when it is integrated with, and fully supports, your business plan and personal goals. Our approach to tax planning will help you better understand the tax implications of any proposed course of action, and together we can make the right decisions for your business. Contact us via email link below for more information. for more information contact your Dopkins Client Service Coordinator or Gregory Urban at gurban@dopkins.com