Outsourcing Accounting & Financial Management: A Solution for Businesses of All Sizes

March 27, 2018 | Authored by Albert A. Nigro CPA, CVA

March 27, 2018 – A strong system of accounting and financial management is vital to the success of every business. A business’s strength in this area depends heavily on the quality of the individuals leading this area and the team performing the day-to-day functions.

Learn more about Dopkins Outsource Accounting Services.

Business owners need to address many questions including:

- What level of expertise do we need?

- How many employees do we need?

- How much do we need to pay them?

- How much do we need to invest in technology?

- Are we effectively addressing organizational risk?

The investment in the accounting/finance function needs to be balanced against other vital needs of the business and limits to resources. Outsourcing all or part of this function is a solution that can provide value to your organization that goes beyond the numbers.

Businesses of all sizes and at various stages of development can realize benefits from outsourcing. Common company profiles include: Start-up companies, Middle market and high-growth companies, companies looking to scale resources up and down as needed, businesses looking to leverage technology and businesses looking to concentrate on growing their business rather than back-office operations.

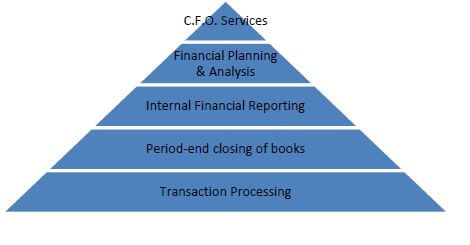

One of the key benefits of outsourcing is the flexibility to engage outside experts to assist you in areas that will provide the greatest value to your business. A hierarchy of services includes:

Business owners are constantly evaluating their organization’s effectiveness at confronting challenges and seizing opportunities. Incorporating an outsourcing strategy can help on both fronts by providing:

- Access to expert advice in a broad range of areas

- Access to the latest technology

- Reduced organizational risk related to fraud, information security, internal controls, compliance, etc.

- Reduced business costs

- Improved cash management

- Improved staff productivity

- Improved quality, timing and accuracy of reporting to allow for more informed decision-making

For a printable copy of this article, please click here.

To learn how Dopkins & Company can help you assess your outsourcing needs, please contact Al Nigro at anigro@dopkins.com.

About the Author

Albert A. Nigro CPA, CVA

Albert A. Nigro CPA, CVA is a partner in the Tax Advisory Group of Dopkins & Company, LLP. As the leader of Dopkins CAAS team, he focuses on developing solutions for clients to help them improve their finance and accounting functions through re-engineered processes, digital transformation and optimal utilization of talent.