New for 2016: IRS Increases Penalties on Information returns

April 7, 2016 | Authored by Eric R. Soro CPA

April 7, 2016 – The Trade Preferences Extension Act of 2015 reads as follows:

“An Act to extend the African Growth and Opportunity Act, the Generalized System of Preferences, the preferential duty treatment program for Haiti, and for other purposes.”

Sounds like a worthy Act. Who is going to pay for it has always been the biggest question. Buried deep in the last section above the payment for renal dialysis services and below customs user fees sits “Penalty for failure to file correct information returns and provide payee statements.”

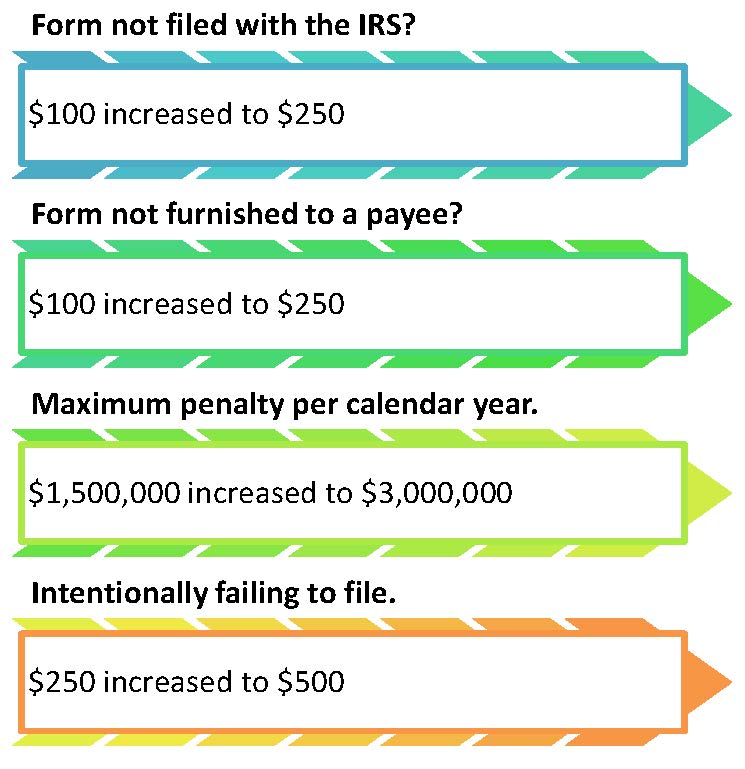

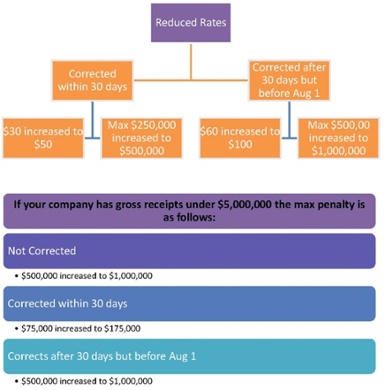

Now whether you were aware or not there has always been penalties associated with failure to file information returns such as Forms W-2, 1098, 1099s, 1042-S. Following is a sample of the increased penalties:

For a more complete list of informational returns, see General Instructions for Certain Information Returns.

The point! File your informational returns as this law begins January 1, 2016.

Of course, if you have any questions, contact Eric Soro at esoro@dopkins.com or your Dopkins Tax Advisor.

About the Author

Eric R. Soro CPA

Eric, embraces the challenges of taxes and puts them to work for the client. He focuses on every aspect of a client's needs, from preparing top-level corporate and partnership returns through to the culmination of member and shareholder individual returns. Taking into account the ever changing tax laws, Eric researches the complex topics that affect his client's taxes so that he may efficiently plan his process and yield the optimal results. He joined Dopkins as an intern in 2006 then full-time in 2007 upon graduation.